Tax-Efficient Strategies to Maximize Philanthropy

In the words of Winston Churchill, “We make a living by what we get, we make a life by what we give.” Many of our clients embody this wisdom, embracing generosity as a cornerstone of their lives. While the altruistic act of giving is a reward, we are here to help our clients amplify the impact of their generosity. In this paper, we discuss three tax-efficient charitable giving strategies we often recommend our clients employ.

Strategy #1: Donating Appreciated Stock to Optimize Tax Efficiency

Most donors write checks to their charities, yet they own appreciated investments that could boost their giving and lower their taxes. Let’s go through an example showing why donating appreciated stock can be more tax-efficient than donating cash.

- Instead of giving $10,000 in cash to your charity, send it to your brokerage account

- You then donate your prized NVIDIA position that has more than tripled in value in the past 10 years (also worth approximately $10,000) to your charity of choice

- Then you repurchase those same NVIDIA shares in your account with that cash you contributed, resetting your cost basis to current market value.

Donor-Advised Funds: The Easiest Way to Donate Appreciated Stock

A Donor-Advised Fund (DAF) is a donation vehicle that simplifies charitable giving, especially when it comes to donating appreciated stock. DAFs provide a tax-efficient way to “Give, Grow, and Grant.” You can donate a variety of assets including publicly traded investments, private equity positions, preferred shares, and more.

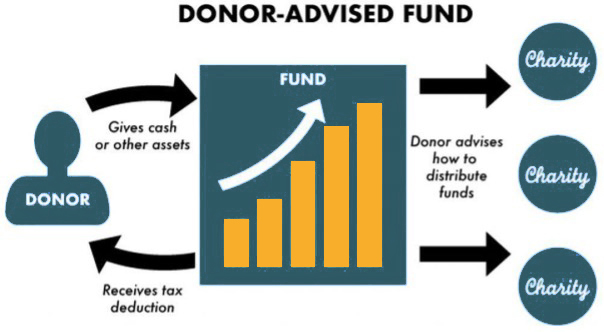

How a Donor-Advised Fund (DAF) Works

A custodian like Charles Schwab sponsors the DAF and partners with a section 501(c)(3) organization, also known as a sponsoring organization, to manage the fund. Your deduction occurs when the asset transitions into the fund, which allows you full control over the timing of donations. You manage your investment after the transfer but cannot revoke the gift.

Eventually, you will sell the asset in your DAF and your advisors will rebalance the position into a diversified basket of investments. This diversified approach minimizes exposure and promotes wealth generation in the long run.

DAFs are structured to make tax-efficient charitable giving easy. By donating to a single location, this strategy helps promote simplistic tax reporting and document tracing. A sole receipt is yielded, which will guarantee brownie points with your accountant in April!

DAF Process Overview:

1. Donate the asset

2. Immediately receive the tax deduction

3. Let donated assets appreciate tax-free

4. On your timing, instruct the DAF to send money to your charity of choice.

Primary Benefits of using a DAF

- Control of timing on deductions

- Diversification

- Ease of reporting

- Maximize charitable giving

Strategy #2: Bunching Appreciated Assets for Charitable Contributions

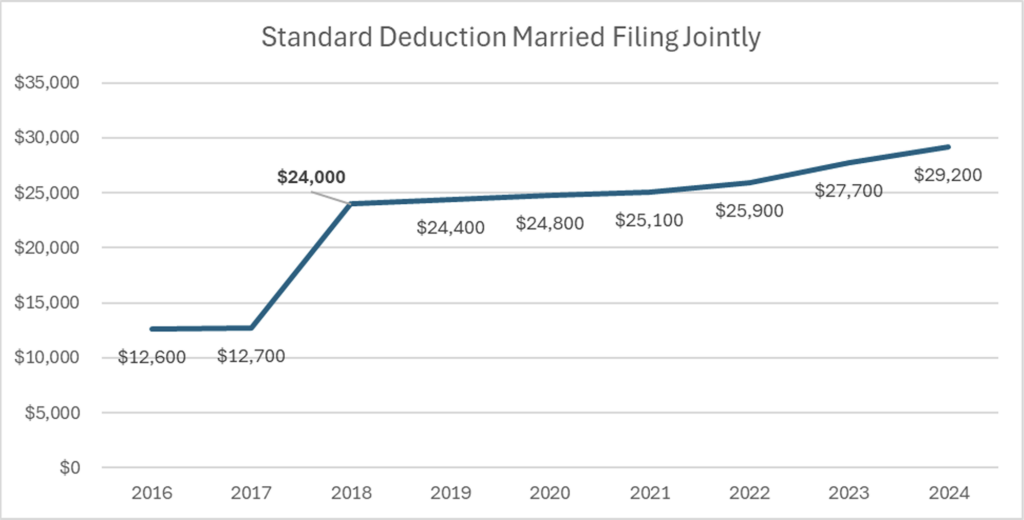

The US tax code has historically rewarded taxpayers for donating their hard-earned savings towards charitable pursuits. Although many of the changes are set to expire at the end of 2025, the tax overhaul of 2017 dramatically increased the standard deduction in an effort to simplify the tax filing process. An unfortunate side effect of this change was the elimination of the deductibility of charitable contributions for most filers.

Despite this apparent problem, a workaround exists if you are willing to plan ahead. It is possible to take advantage of the amplified tax savings associated with the higher standard deduction AND get a deduction for your charitable contributions by bunching your donations*.

*Assuming an investment account exists with appreciated assets

Example of Bunching Charitable Donations Through a Donor-Advised Fund

The Problem

Kelly and Kelsey find themselves in the same boat as many donors because their itemized expenses don’t add to greater than the standard deduction. They donate $5,000 annually but feel the system is unfair. They own $20,000 in Microsoft stock which has doubled in value since purchase. They came to Rosel Wealth Mangement wondering how they could make the most out of their generosity.

Pre-Bundled Donation Details

- Kelly and Kelsey have a combined income of $250,000 a year

- They currently take the standard deduction: $29,200

- Current itemizable expenses:

- Property Taxes: $2,650*

- State income taxes: $11,000

- Yearly Mortgage interest paid: $12,010

- Yearly Donations: $5,000

- Total Deductible expenses: $27,010

*Assumes Kelly and Kelsey own a house worth $500,000, and are halfway through paying off a 30-year loan for $400,000 at a 5% interest rate

The Solution

As a tax-efficient charitable giving strategy, we advised them to do a bundled donation of their Microsoft stock in 2023. This allowed them to maximize their itemized deductions and surpass the standard deduction threshold in 2023.

Additional Tax Deductions Through Bundling: $14,311 Additional Tax Savings: $3,435

(14,300 * 24% marginal tax rate)

Strategy #3: Promote Tax-Efficient Giving with Qualified Charitable Distributions

We often recommend utilizing Qualified Charitable Contributions (QCDs) to all our clients over the age of 70 ½. QCDs allow you to directly transfer funds from your taxable IRA to a qualified charity.

Withdrawals from an IRA are taxed as ordinary income. QCDs solve this problem by transferring your money to charity and reducing income that normally would be taxed by the IRS in the year taken. Furthermore, individuals over the age of 73 are subject to Required Minimum Distributions (RMDs) from their IRA. By donating prior to age 73, you are reducing the size of your IRA and lowering future RMDs, which lowers taxation. In addition, after 73, QCDs can help fulfill or take the place of RMDs.

Harness Tax-Efficient Charitable Giving Strategies with Rosel Wealth Mangement

Charitable giving doesn’t have to come at the expense of long-term wealth. As we’ve outlined, strategies like donating appreciated assets, leveraging donor-advised funds, bunching contributions, and using qualified charitable distributions can all help you give more—all while keeping your financial plan on track.

If you’re looking to align philanthropy with your wealth strategy, Rosel Wealth Mangement can help you design a personalized approach to tax-efficient charitable giving that supports the causes you care about and keeps you on track for continued financial success.

Investment advisory services are offered through Rosel Wealth Management, a registered investment adviser. Registration with any regulatory body does not imply any particular level of skill. This material is provided for informational purposes only and should not be construed as investment, tax, or legal advice. All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results. The scenarios presented are hypothetical and are intended for illustrative purposes only. They do not reflect actual client results and are not guarantees of future outcomes. Individual results will vary. Certain financial strategies may offer tax advantages, but outcomes depend on individual circumstances and are subject to change due to tax laws and other external factors. Consult a tax professional. Certain statements herein may reflect the firm’s current views, expectations, or beliefs, which are subject to change without notice. For additional information about our services, fees, and disclosures, please refer to our Form ADV Part 2A, available at https://morganrosel.com or upon request at no cost.

Donor-Advised Funds offer a streamlined and tax-efficient method for charitable giving, but they involve certain limitations. Contributions to a DAF are irrevocable and donors relinquish control over the assets. While recommendations for grantmaking can be made, the sponsoring organization retains final authority. Fees, limited investment flexibility, and potential delays in disbursement should be carefully considered before contributing to a DAF.

This commentary reflects the personal opinions, viewpoints and analyses of the Rosel Wealth Management, LLC (“RWM”) employees and guests providing such comments, and should not be regarded as a description of advisory services provided by RWM or performance returns of any RWM Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. RWM manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss, including the loss of principal. Past performance is no guarantee of future results. RWM may recommend the services of a third-party attorney, accountant, tax professional, insurance agent, or other specialist to clients. RWM is not compensated for these referrals. RWM does not provide tax or legal advice. Please consult a tax or legal professional for guidance on your individual circumstances.