College Funding Strategies for High-Net-Worth Families

One of the most difficult tasks of going to college is considering how to pay for the rising costs of attendance. Fortunately, several college funding strategies for high-net-worth families exist that can help ease the financial burden. With the proper guidance, families can ensure that their children receive quality education without compromising their financial health. Whether you decide to fund college by taking out student loans or by using a tax-efficient 529 college savings plan, it is important to have a plan.

While a college degree may seem overpriced, it will ultimately pay for itself. The average bachelor’s degree holder earns 86% more than high school graduates. In one year alone, that’s an extra $38,930, which is enough to pay for three semesters of current expenses at an in-state public college.

Furthermore, unemployment rates have consistently been lower for college graduates compared to just high school graduates. Consequently, a college diploma has become a necessity for finding and keeping a good job. Figure 1 demonstrates the highest-paying entry-level positions available to graduates, which as previously stated, is significantly higher than the average non-college graduate.

Tax-Advantaged 529 Plans: College Funding for High-Net-Worth Families

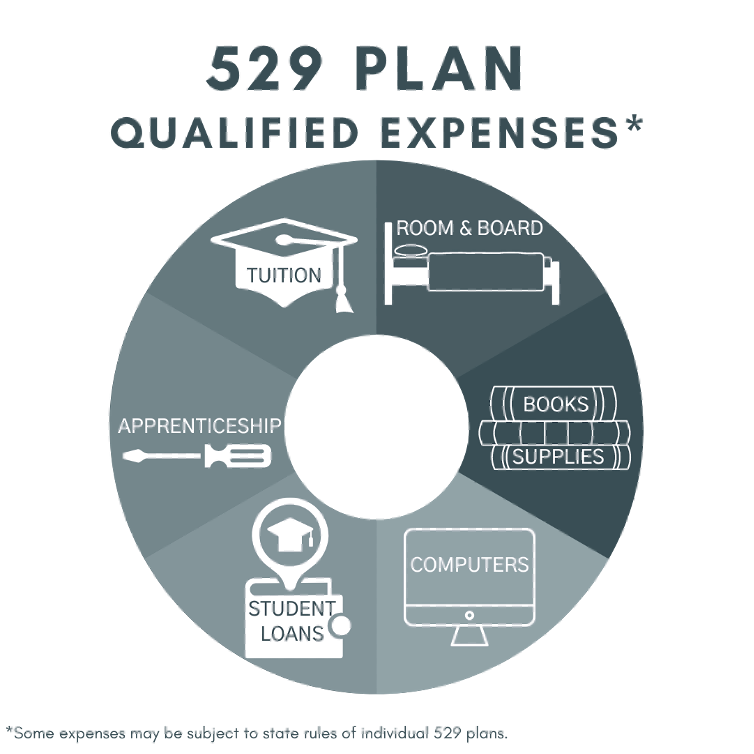

One of the most tax-advantaged college funding strategies is a 529 college savings plan. For high-net-worth families, understanding the nuances of advanced 529 planning can unlock significant benefits, including estate planning advantages and potential for generational wealth transfer related to educational funding.

The primary benefit remains that all earnings in the account accumulate tax-free, and no federal income tax is owed on withdrawals if they are for educational expenses. The IRS defines educational expenses as tuition, fees, and other related expenses. The following expenses do not qualify for payment from a 529 college savings plan:

- Insurance

- Medical expenses (including student health fees)

- Transportation

- Similar personal, living or family expenses.

Withdrawing for expenses that do not qualify will incur income tax on the portion of the withdrawal that’s attributed to earnings plus a 10% penalty. For families considering larger contributions or utilizing 529s as part of their broader financial strategy, it’s crucial to keep receipts of withdrawals from the account to prove they were qualified expenses and to consult with a financial advisor on optimal contribution strategies and potential gift tax implications.

Scholarships and Federal Aid

In many cases, a 529 college savings plan will not cover the full cost of college, so other options such as federal grants and scholarships should be considered. The first step is to fill out the FAFSA form, which can determine eligibility for federal grants and scholarships, effectively lowering the cost of attendance for students if deemed eligible. Additionally, merit scholarships are plentiful among public universities, applying for these can also reduce students’ bills and, in some cases, eliminate it. Students should take the time to fill out these applications.

Student Loans

After considering all scholarships and federal grants available, if there are still expenses to cover, students can explore options for student loans. Federal loans, determined by the FAFSA, include direct subsidized and direct unsubsidized loans, which have the advantage of the government covering interest while the student is in school. Unsubsidized loans, on the other hand, are not based on financial need and will incur interest from the moment the loan is disbursed until it is fully paid off. Neither Federal loan type requires a credit check or a previous credit score.

Students should also consider private loans, such as those offered by financial institutions. However, private loans often have higher interest rates and fewer benefits compared to federal loans, and they may require a good credit score to qualify. Many colleges offer work-study programs that can reduce the amount of money that may be needed to borrow by working a part-time job on campus. While most of these programs only pay minimum wage, they are offered at most public institutions and are federally funded to help students pay off their loan debt. So, before taking out a student loan, students should plan and consider all options to cover their tuition costs to be debt-free after college.

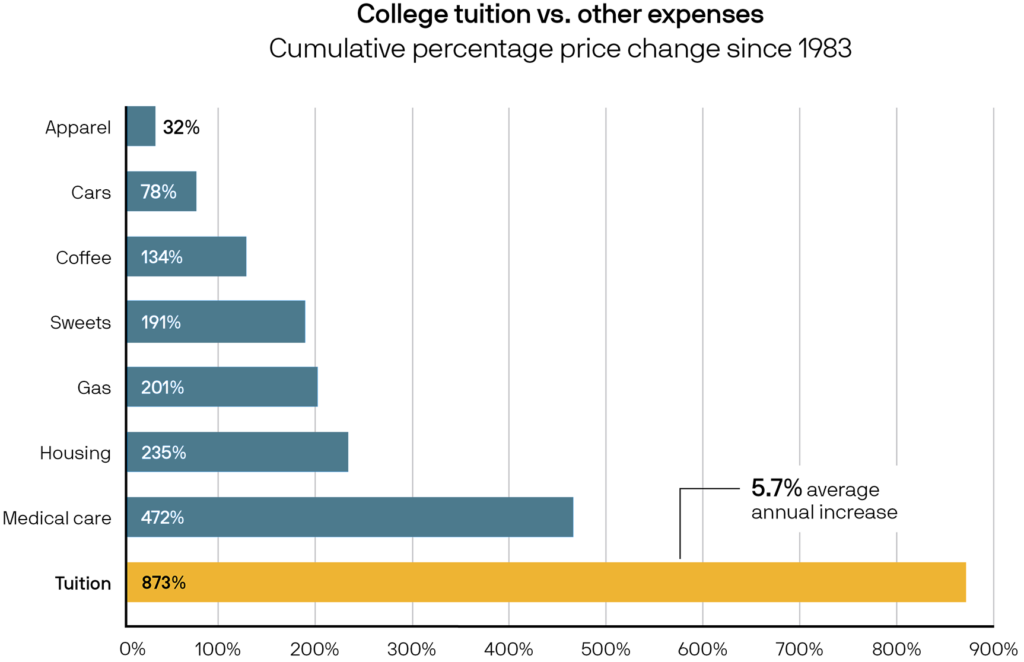

The Shortcomings of College

Even with college funding strategies, the number one barrier to enrolling in college is the cost. College costs have ballooned in the past three decades, nearly doubling in price. While some of this influx is due to inflation, a lot of it is due to the increase in demand for a college education along with increases in administrative and operating costs with little to no improvement in the value of a degree. The average cost to attend an in-state college across the United States is $103,572 and $180,680 for out-of-state over a four-year degree and these prices will continue to rise at an average rate of 5.7% yearly.

With prices being so high, the idea of going to college is almost unfathomable for a lot of Americans. Taking on such a stark amount of debt is daunting at a young age, and the crushing weight of this debt is rightfully too much to handle for many people.

What is Credit?

In addition to college and associated expenses, a key financial tool to understand is credit. Credit is an agreement between a borrower and a lender to temporarily obtain money that will be due back at a later period. Credit agreements consist of a timeline of payments including a portion of the principal amount of the money borrowed with interest on top of it. If the transaction goes according to plan, credit is built which is reflected by your credit score.

For families with substantial assets, instilling sound financial principles in their children early on is often a priority. In this context, a credit card, when used responsibly, can serve as an educational tool for navigating financial obligations and building a foundation for future fiscal management. Understanding a student’s developing credit habits can be relevant for long-term family financial planning, particularly as it relates to future asset management and potential co-signing or financial support for significant purchases.

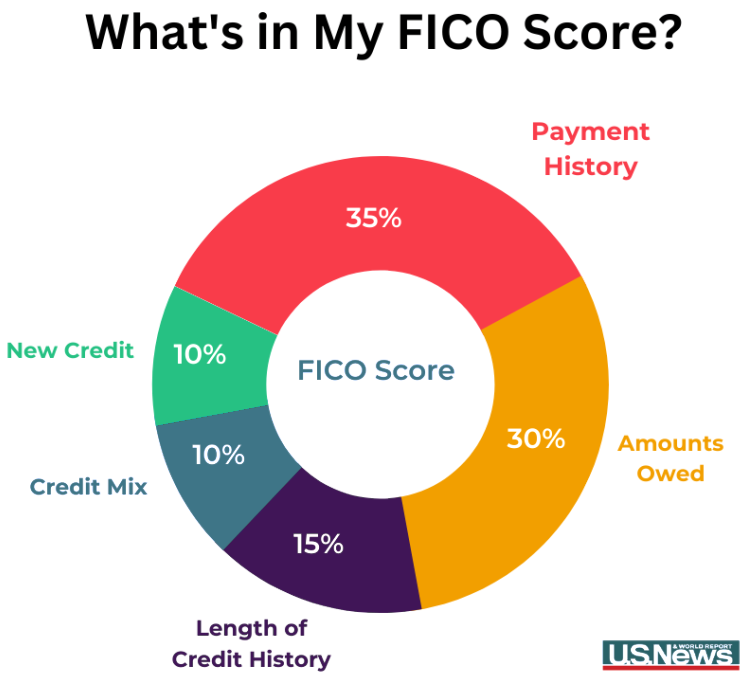

Understanding Credit Score for College Students

An important factor when taking on debt is your credit score. A credit score is a three-digit number derived from your credit history that indicates how effectively you can manage your debt. It is a tool used by lenders to anticipate your ability to pay back your debt on time and in its full amount. The following are ways to increase your credit:

- Payment history: The record of on-time and late payments from loans and credit cards (35%).

- Amounts owed: Also known as your debt-to-credit ratio, it is how much money you owe and how much of your credit card limit you’ve used (30%).

- Duration of credit history: The length of time your credit accounts have been open (15%).

- Having different types of credit (Credit mix): The more types of credit (auto loans, student loans, mortgage, credit cards) you have, the better (10%)

- Amount of credit inquiries: When someone verifies your credit when you purchase credit, it decreases your score (10%).

Although the need for basic credit might be less pressing for high-net-worth families, understanding the mechanics of credit scoring remains valuable. This knowledge can be particularly relevant as these students transition to managing significant personal assets or when considering financing for major acquisitions later in life, where even with considerable wealth, leveraging credit strategically can be advantageous.

The Downside of Credit Cards

- Extremely high interest rates if debt is not paid off

- Many credit card companies charge yearly fees

- Provide a false sense of financial capability if the borrower isn’t smart with their purchasing habits

- Missing payments will result in a lowered credit rating decreasing the possibility of obtaining capital.

While these downsides are universally important, families with significant wealth often prioritize instilling sound financial discipline in their children. Open communication and the establishment of clear guidelines around credit card usage become essential tools in cultivating responsible spending habits and preventing potential financial mismanagement.

What Kind of Credit Card Should a College Student Should Get

There are many types of credit cards all with different perks, fees, and interest rates. Finding the one that is best suited for you is vital. It is important to note that no one should carry a balance on a credit card. When you carry a balance, it puts you at risk of paying extremely high interest rates. When you pay back the balance on time, the interest rates will have no impact, thus, interest rates should be the last priority on the list when choosing a credit card.

The card we do recommend is a credit-building card. These are designed specifically to improve your credit score with as little credit risk as possible. They additionally provide perks such as no fees, free FICO credit verification, and lower-cap credit maximums. Examples include secured credit cards, unsecured credit-building cards, and student credit cards.

Specialized College Funding Guidance for High-Net-Worth Families

From strategically utilizing tax-advantaged 529 plans to understanding the role of credit in building long-term financial health, planning for college presents unique considerations for high-net-worth families. At Rosel Wealth Management, we understand the complexities involved in ensuring your children receive an exceptional education while aligning these goals with your broader wealth management objectives.

Our firm offers tailored guidance and comprehensive financial planning solutions to help families create college funding strategies. Contact us today to explore how our personalized approach can support your family’s quest for higher education.

Investment advisory services are offered through Rosel Wealth Management, a registered investment adviser. Registration with any regulatory body does not imply any particular level of skill. This material is provided for informational purposes only and should not be construed as investment, tax, or legal advice. All investments involve risk, including the possible loss of principal. Past performance does not guarantee future results. The scenarios presented are hypothetical and are intended for illustrative purposes only. They do not reflect actual client results and are not guarantees of future outcomes. Individual results will vary. Certain financial strategies may offer tax advantages, but outcomes depend on individual circumstances and are subject to change due to tax laws and other external factors. Consult a tax professional. Certain statements herein may reflect the firm’s current views, expectations, or beliefs, which are subject to change without notice. For additional information about our services, fees, and disclosures, please refer to our Form ADV Part 2A, available at https://morganrosel.com or upon request at no cost.

This commentary reflects the personal opinions, viewpoints and analyses of the Rosel Wealth Management, LLC (“RWM”) employees and guests providing such comments, and should not be regarded as a description of advisory services provided by RWM or performance returns of any RWM Investments client. The views reflected in the commentary are subject to change at any time without notice. Nothing on this website constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. RWM manages its clients’ accounts using a variety of investment techniques and strategies, which are not necessarily discussed in the commentary. Investments in securities involve the risk of loss, including the loss of principal. Past performance is no guarantee of future results. RWM may recommend the services of a third-party attorney, accountant, tax professional, insurance agent, or other specialist to clients. RWM is not compensated for these referrals. RWM does not provide tax or legal advice. Please consult a tax or legal professional for guidance on your individual circumstances.